Roth 401k conversion tax calculator

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Colorful interactive simply The Best Financial Calculators.

Systematic Partial Roth Conversions Recharacterizations

Use the tool to compare estimated taxes when you do.

. The VeriPlan Roth IRA conversion calculator feature running on Microsoft Excel functions as a Roth IRA predictor enabling year-by-year Roth conversion analysis. A 401 k can be an effective retirement tool. This calculator can help you make informed decisions about performing a Roth conversion in 2022.

Roth 401 k contributions allow. Converting to a Roth IRA may ultimately help you save money on income taxes. Find Fresh Content Updated Daily For Roth ira conversion tax calculator.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. Ad Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K. Roth 401 k Conversion Calculator.

Traditional 401 k and your Paycheck. Roth 401k Conversion Calculator With the passage of the American Tax Relief Act any 401k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401k. Once You Retire You Wont Pay Taxes When You Withdraw Your Money.

Roth Ira Conversion Methods. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. One big decision is whether or not you should convert your traditional IRA into a Roth IRA. Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will.

Free withdrawals on contributionsCommon retirement plans such as 401ks and traditional. Pros of Roth IRA. With a 60-day indirect rollover you.

How To Calculate Max 401k Contribution. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. Explore The Advantages of Moving an IRA to Fidelity.

Roth 401 k Conversion Calculator. There are several ways to enact a Roth conversion depending on where you hold your retirement accounts. Roth 401 k Conversion Calculator.

Roth IRAs are the only tax-sheltered retirement plans that do not impose RMDs. As of January 2006 there is a new type of 401 k contribution. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert.

Retirement savers who convert pre-tax retirement accounts such as IRAs to. This calculator will show the advantage if any of converting your pre-tax 401 k to a Roth 401 k. This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement.

For some investors this could prove. Ad Roll Over Existing IRA Accounts and Manage Your Fidelity Account Today. Expected Federal Income Tax Rate at RetirementBased on your income at retirement the amount of federal income taxes you expect to pay at retirement as compared to your current federal.

401k IRA Rollover Calculator. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Roth Conversion Calculator Methodology General Context.

Your IRA could decrease 2138 with a Roth. This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. You May Like.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Roth IRA is a great way for clients to create tax-free income from their retirement assets. With the passage of the American Tax Relief Act any 401 k plan that allows for Roth contributions will now be eligible to convert existing pre-tax 401 k.

2022 Roth Conversion Calculator. Converting An Ira To Roth After Age 60. When planning for retirement there are a number of key decisions to make.

With the passage of the American Tax Relief Act any. For instance if you expect your income level to be lower in a particular year but increase again in later years.

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

How I M Using A Roth Ira Conversion Ladder To Access Retirement Funds Early A Step By Step Guide A Purple Life

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Roth Conversion Calculator Fidelity Investments

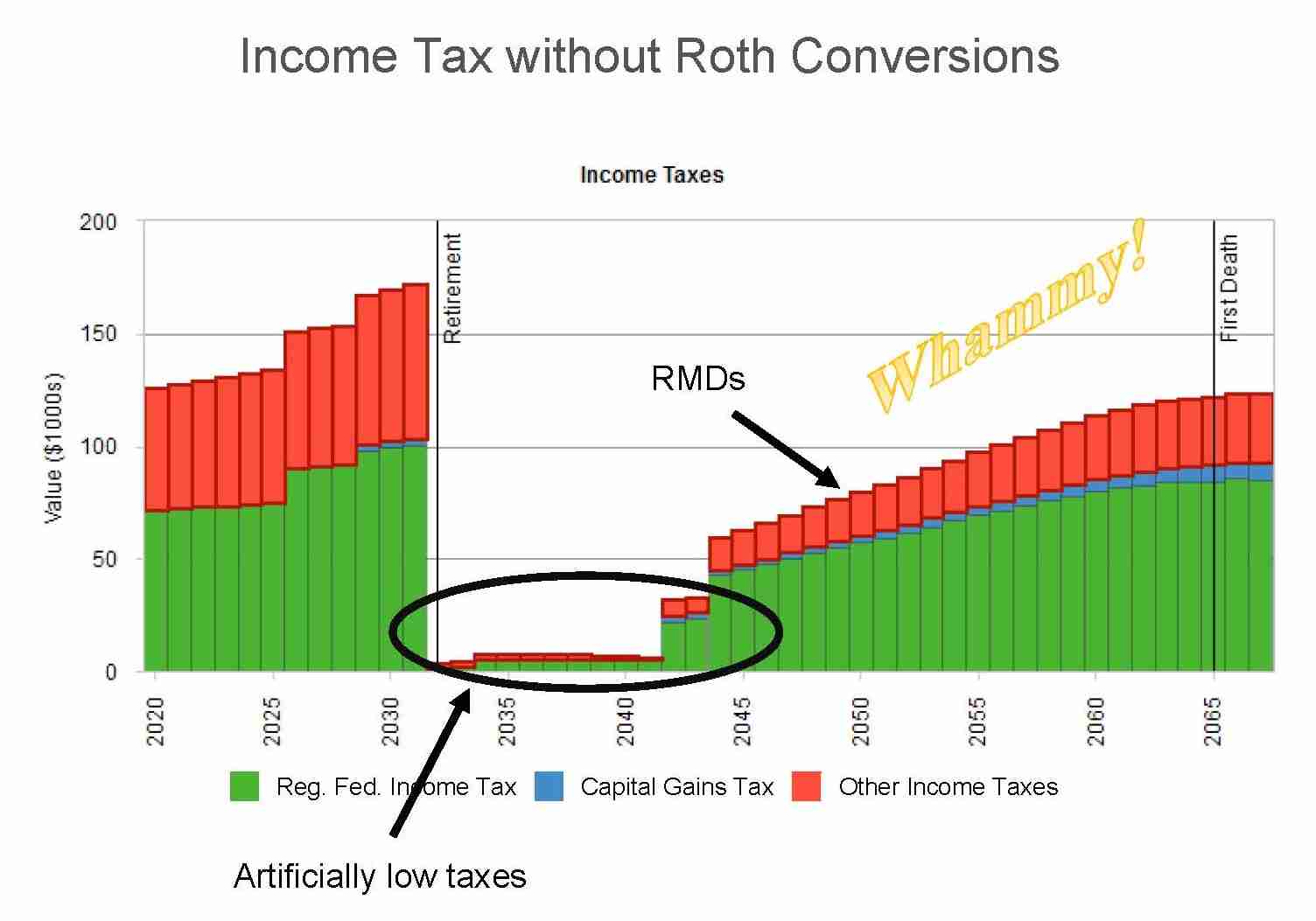

The Tax Planning Window And Partial Roth Conversions For 401k Millionaires White Coat Investor

How To Use Tax Distribution And Conversion Tool Help Center Financial Planning Software Rightcapital

Diy Roth Conversion Engine Template Bogleheads Org

Roth Ira Conversion 2012 Roth Calculator For Prof Low Income Marotta On Money

A Betr Calculation For The Roth Conversion Equation Vanguard

Roth Ira Conversion Calculator Converting An Ira Schwab Roth Ira Conversion Roth Ira Conversion Calculator

Roth 401 K In Plan Roth Conversions Morgan Stanley At Work

The Bold And Beautiful Roth Conversion Ladder Clipping Chains

The Ultimate Roth Ira Conversion Guide For 2022 Rules Taxes

Systematic Partial Roth Conversions Recharacterizations

Converting An Ira To A Roth Ira After Age 60 Carmichael Hill

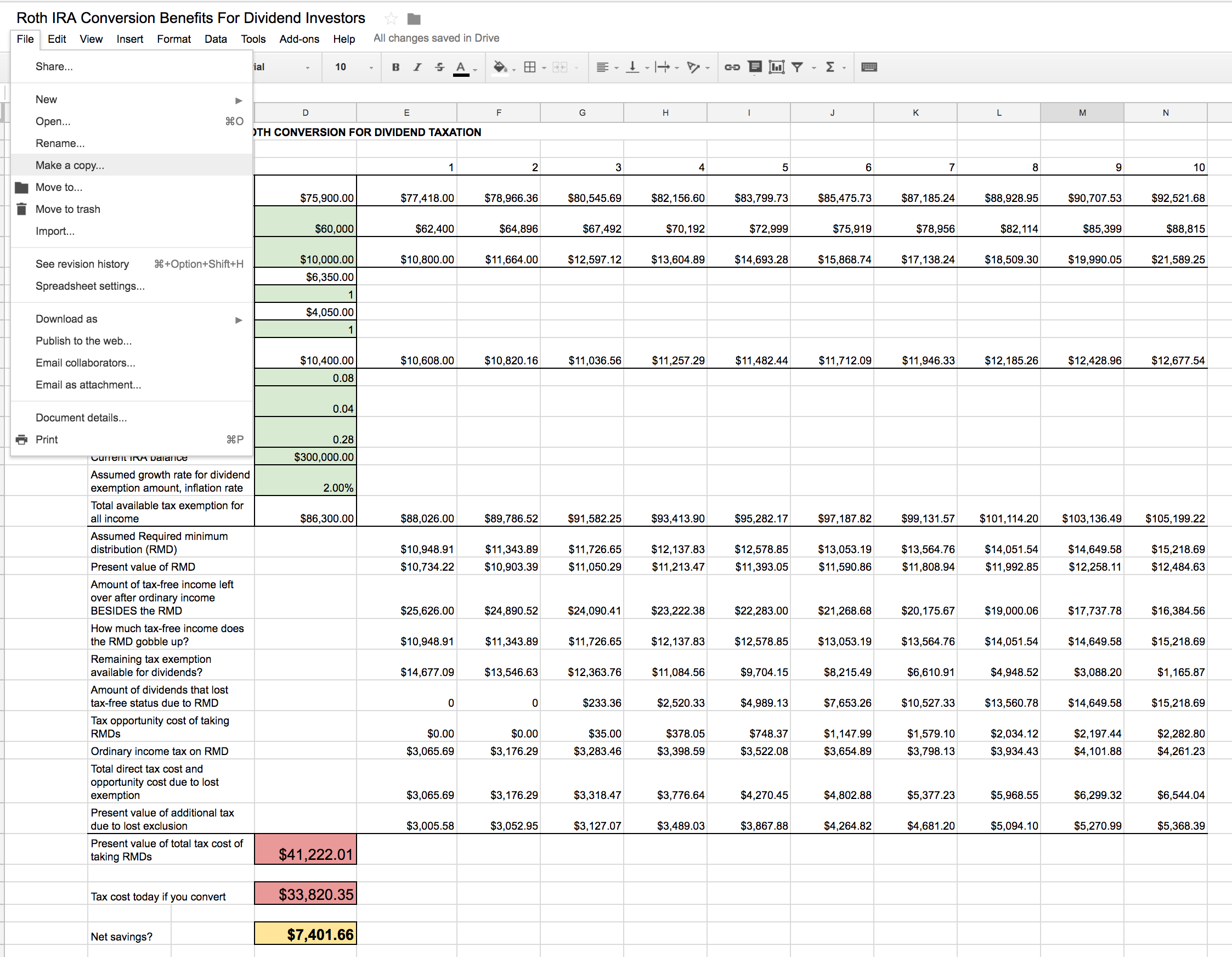

Roth Ira Conversion Spreadsheet Seeking Alpha

The Most Accurate Roth Conversion Calculator You Ll Find