Average withholdings from paycheck

The average tax filer would have received roughly an additional 247 per month if they adjusted their withholding to neither get a refund nor owe taxes. With information on rates and the different kinds of loans this guide puts the mortgage-related info you care about in one place.

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

SmartAssets Washington paycheck calculator shows your hourly and salary income after federal state and local taxes.

. Adjusting your withholding could move your refund to your paychecks. Like your marital status salary and if you want any additional withholdings. When an employee receives a reduced paycheck their tax liability decreases since their gross wage is less than their typical weekly pay.

MAR 31 2020. For those considering buying a home in Delaware our mortgage guide is a great place to start the process of getting a mortgage. Based on an employees updated wage and prorated salary youll likely need to withhold less Social Security and Medicare taxes and adjust the local state and federal income tax withholdings.

You have to enter information about your filing status and dependents on your Form W-4 which allows your employer to know how much to withhold. Sole proprietors and self-employed individuals can begin making contributions to the trust fund also 12 of 1 percent of wages. If you live or work in the city of Wilmington you also have to pay a 125 local income tax also known as the City Wage Tax.

JAN 1 2021. End of 1st quarter first payment is due payments can also be submitted during the quarter. If getting your refund throughout the year rather than at tax time sounds appealing you can adjust your withholding today.

Percent of each paycheck to the CT Paid Leave Authority trust fund.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

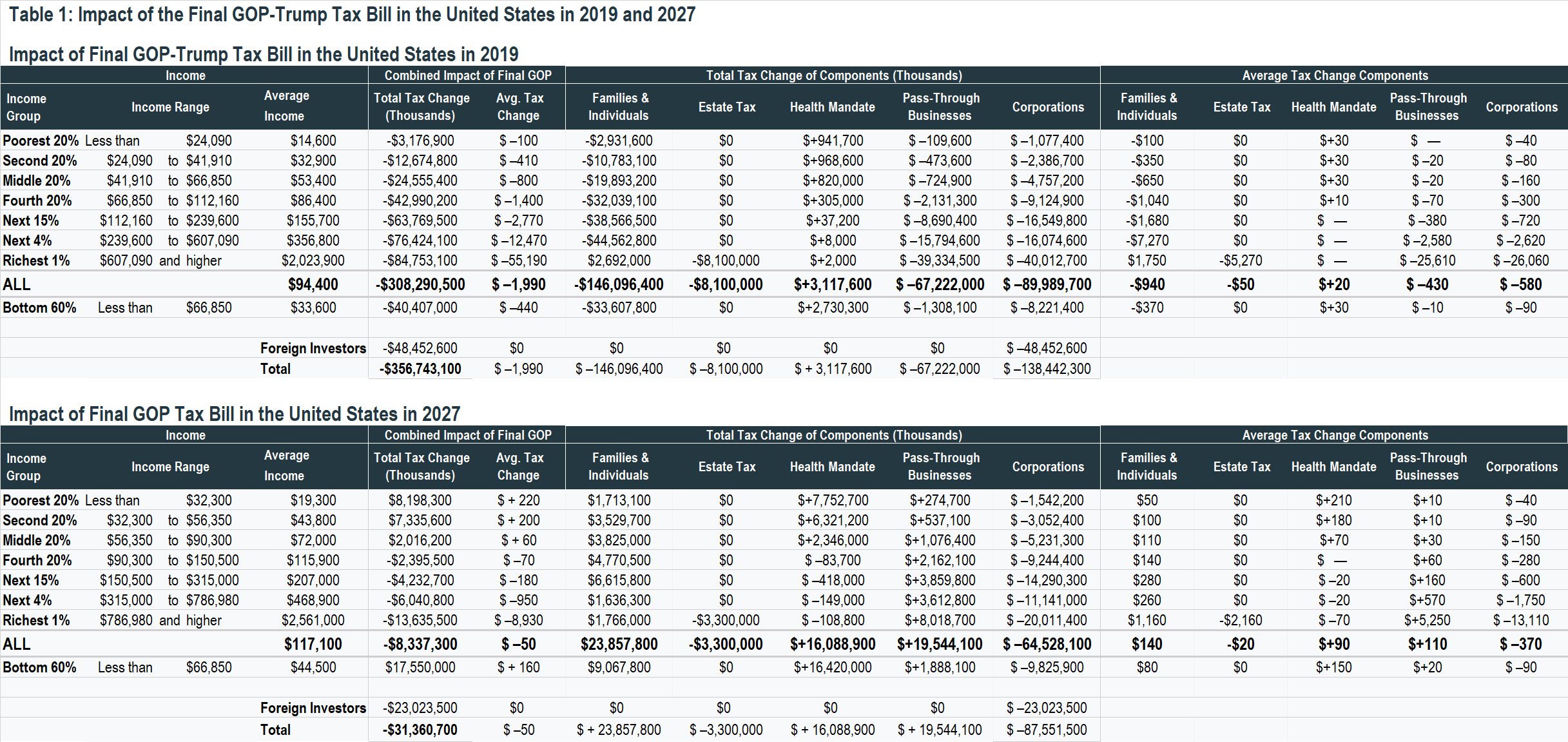

How Much Will Typical Middle Class Workers Really See Their Paychecks Change Itep

An Overview Of Paycheck Deductions

2022 Federal State Payroll Tax Rates For Employers

Tax Withholding For Pensions And Social Security Sensible Money

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

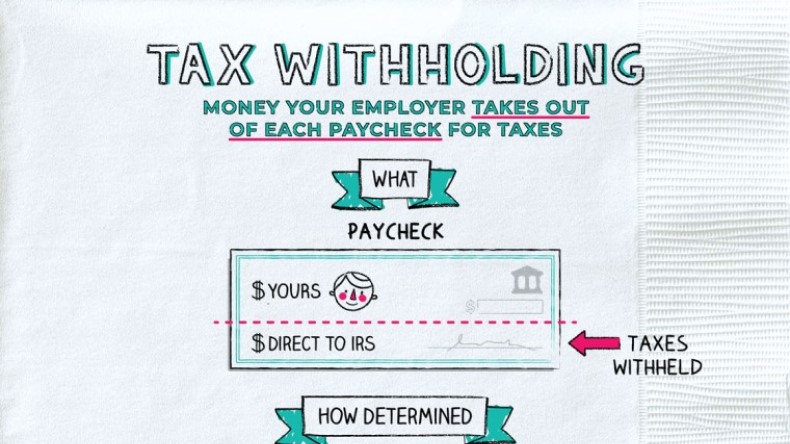

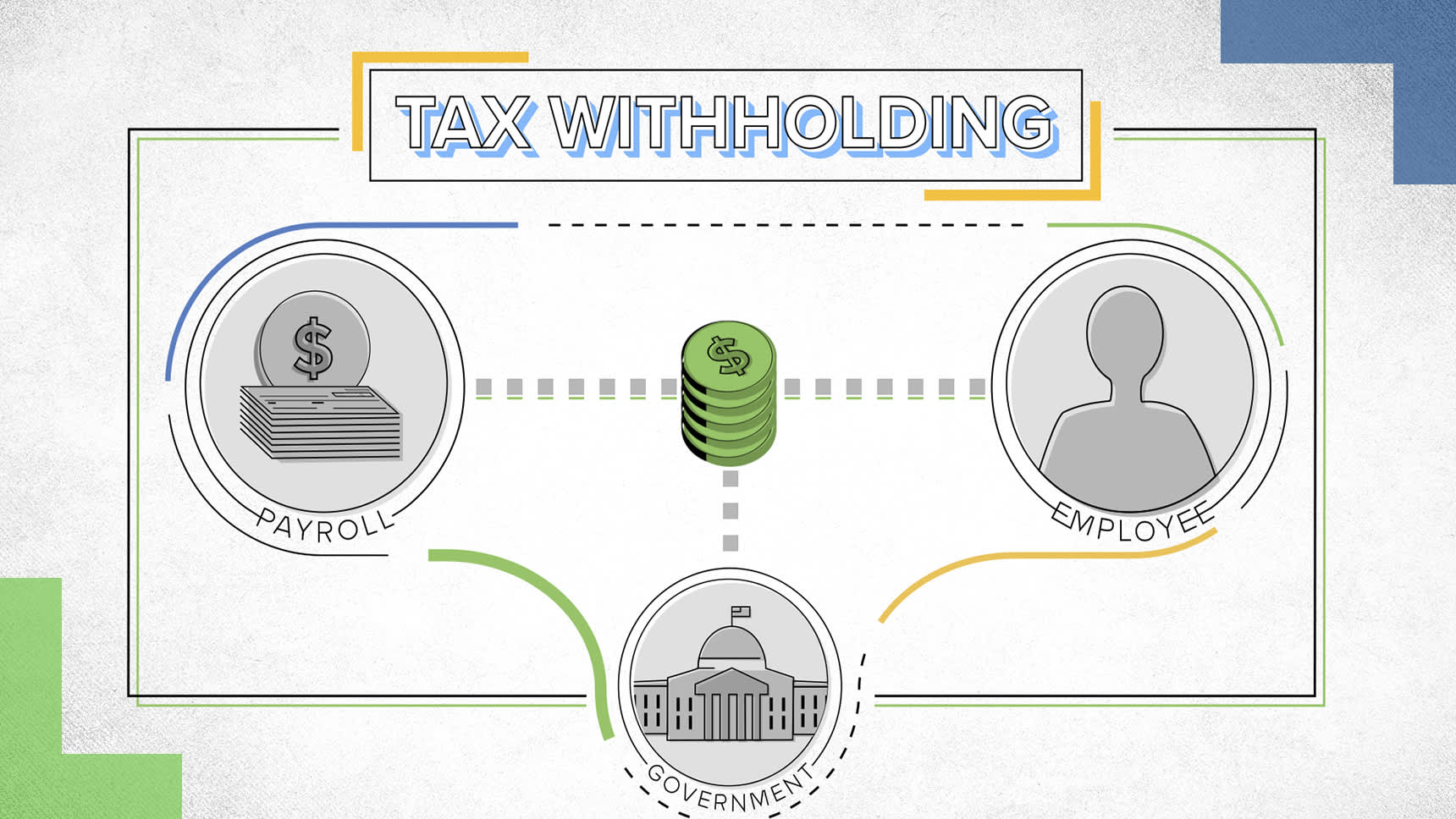

What Is Tax Withholding All Your Questions Answered By Napkin Finance

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Understanding Your Paycheck Credit Com

Check Your Paycheck News Congressman Daniel Webster

45 Of Americans Don T Know How Much Tax Is Withheld From Their Pay

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Payroll Tax Vs Income Tax What S The Difference

Ohio Paycheck Calculator Smartasset

How To Read A Pay Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp